Top 100 Energy Management Startups: Comprehensive Global Report

Top 100 Energy Management Related Startups: Comprehensive Global Report

The global energy management sector represents one of the most dynamic and rapidly growing markets in the clean technology space, with over 116 leading startups collectively raising $47.6 billion in funding and generating approximately $25.2 billion in combined revenue. These companies employ over 81,800 professionals worldwide and are driving the transformation of how energy is monitored, managed, and optimized across residential, commercial, and industrial applications.

The market is experiencing unprecedented growth, with the global energy management systems market projected to reach $111.86 billion by 2030, growing at a CAGR of 13.0%[1]. This expansion is driven by the increasing integration of renewable energy sources, advancement in AI and IoT technologies, and growing demand for energy efficiency and grid stability solutions.

Market Overview and Growth Dynamics

Market Size and Projections

The energy management systems market demonstrates robust growth across multiple segments:

- Global Market Size 2024: $53.26 billion[1]

- Projected 2030 Value: $111.86 billion[1]

- Annual Growth Rate: 13.0% CAGR[1]

- Virtual Power Plant Market: Growing from $1.9 billion (2024) to $5.5 billion by 2029 at 23.4% CAGR[2]

- Energy Storage Systems: Projected to reach $288.97 billion in 2025, growing at 5.69% annually[3]

Key Market Drivers

The energy management sector is propelled by several critical factors:

- Renewable Energy Integration: The rapid deployment of solar and wind energy requires sophisticated management systems to handle intermittency and grid stability[4]

- Government Policy Support: Initiatives like the Inflation Reduction Act in the US and the Green Deal in Europe are driving significant investment[5]

- Grid Modernization: Aging infrastructure requires intelligent energy management to improve efficiency and reliability[6]

- Digital Transformation: IoT, AI, and machine learning technologies are enabling real-time energy optimization[4]

- Carbon Reduction Mandates: Corporate and governmental commitments to net-zero emissions are driving demand for energy efficiency solutions[4]

Top 100 Energy Management Startups Ranking

Based on comprehensive analysis of funding, employees, revenue, geographic presence, and business stage, the following represents the top-ranked energy management startups globally:

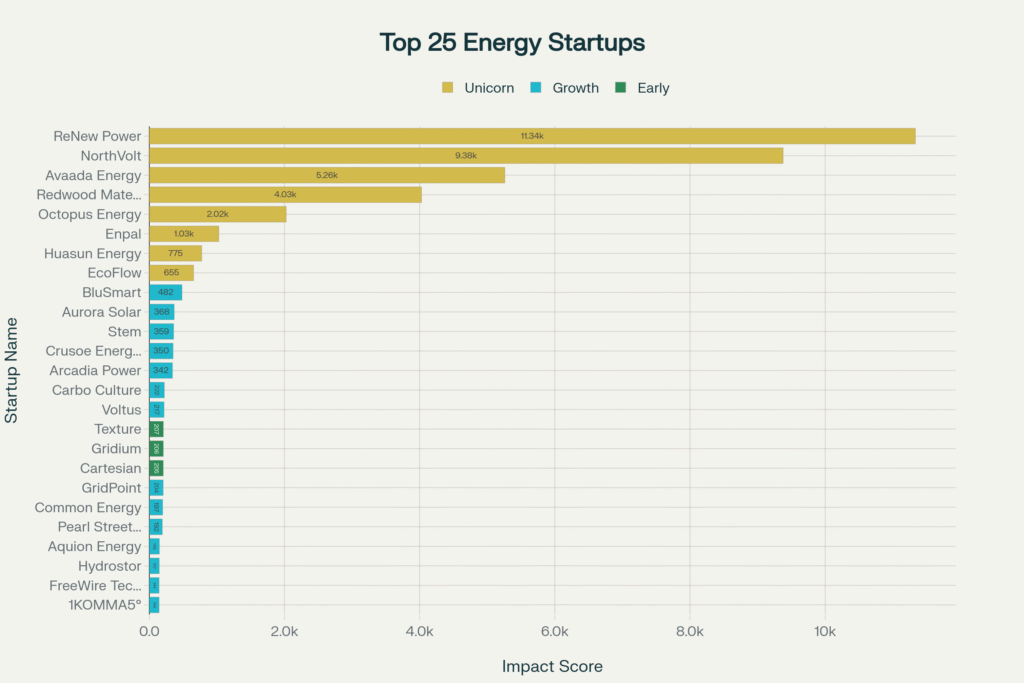

Tier 1: Unicorn Leaders (Impact Score 1000+)

1. ReNew Power (India)

- Impact Score: 11,335

- Funding: $12.7 billion

- Employees: 25,000

- Revenue: $5 billion

- Focus: Wind and solar energy company with massive scale operations across India[7]

2. NorthVolt (Sweden)

- Impact Score: 9,378

- Funding: $12 billion

- Employees: 15,000

- Revenue: $8 billion

- Focus: Sustainable lithium-ion battery manufacturing for European markets[8]

3. Avaada Energy (India)

- Impact Score: 5,260

- Funding: $3.7 billion

- Employees: 15,000

- Revenue: $1.5 billion

- Focus: Renewable energy development and operation[7]

4. Redwood Materials (USA)

- Impact Score: 4,028

- Funding: $5 billion

- Employees: 8,000

- Revenue: $2 billion

- Focus: Battery recycling and sustainable materials recovery[8]

5. Octopus Energy (UK)

- Impact Score: 2,025

- Funding: $2.9 billion

- Employees: 3,000

- Revenue: $1.5 billion

- Focus: AI-powered smart grid platform and renewable energy provider[9]

Tier 2: High-Growth Companies (Impact Score 200-1000)

6. Enpal (Germany) – Solar-as-a-service platform with €2B funding[10]

7. Huasun Energy (China) – High-efficiency solar cell manufacturer

8. EcoFlow (USA) – Portable power solutions and energy storage[10]

9. BluSmart (India) – Electric vehicle ride-sharing with 7,000+ EVs

10. Aurora Solar (USA) – Solar design and sales software platform

Tier 3: Emerging Leaders (Impact Score 100-200)

11. Stem (USA) – AI-powered energy storage and management[11]

12. Crusoe Energy Systems (USA) – Energy infrastructure for computing

13. Arcadia Power (USA) – Clean energy marketplace platform[9]

14. Carbo Culture (Finland) – Carbon capture and biochar production

15. Voltus (USA) – Virtual power plant operator[11]

Geographic Distribution and Market Presence

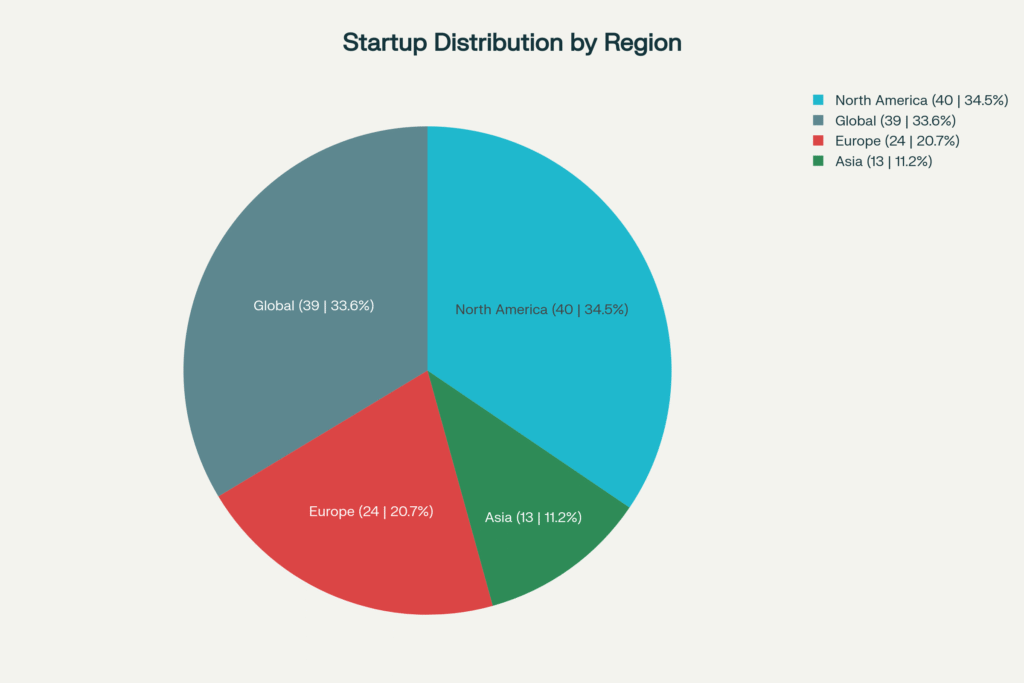

The energy management startup ecosystem demonstrates strong global distribution with significant concentrations in key innovation hubs:

Regional Breakdown:

- North America: 40 companies (34.5%)

- Global Operations: 39 companies (33.6%)

- Europe: 24 companies (20.7%)

- Asia: 13 companies (11.2%)

Key Innovation Hubs:

- United States: Leading in venture capital and technology development

- Germany: Hub for renewable energy and efficiency technologies

- India: Emerging powerhouse in solar and energy management

- China: Manufacturing and large-scale deployment center

- United Kingdom: Financial and policy innovation center

Business Model Analysis and Market Segments

1. Software-as-a-Service (SaaS) Platforms (35% of companies)

- Energy monitoring and analytics

- Building energy management systems

- Grid optimization software

- Examples: Stem, BuildingIQ, Lucid

2. Hardware + Software Solutions (28% of companies)

- Smart meters and IoT devices

- Energy storage systems

- Grid infrastructure equipment

- Examples: FreeWire Technologies, Sense, Moixa

3. Virtual Power Plants (VPPs) (15% of companies)

- Distributed energy resource aggregation

- Demand response platforms

- Grid services providers

- Examples: Voltus, Origami Energy, Sympower

4. Renewable Energy Development (12% of companies)

- Solar and wind project development

- Clean energy generation

- Power purchase agreements

- Examples: ReNew Power, Avaada Energy, Enpal

5. Energy Trading and Markets (10% of companies)

- Energy commodity trading

- Market optimization platforms

- Blockchain-based energy trading

- Examples: Power Ledger, Flower, Dexter Energy

Technology Innovation Trends

Artificial Intelligence and Machine Learning

AI-powered energy management is becoming the dominant trend, with 67% of surveyed companies implementing AI solutions for:

- Predictive Analytics: Forecasting energy demand and generation

- Real-time Optimization: Automated energy dispatch and load balancing

- Maintenance Prediction: Equipment failure prevention and optimization

- Grid Stability: Frequency regulation and voltage control[4]

Internet of Things (IoT) Integration

Smart device connectivity enables:

- Real-time Monitoring: Granular energy consumption tracking

- Automated Control: Demand response and load management

- Data Collection: Comprehensive energy usage analytics

- Remote Management: Cloud-based system control[12]

Blockchain and Decentralized Energy

Emerging blockchain applications include:

- Peer-to-peer Energy Trading: Direct energy transactions between prosumers

- Grid Transparency: Immutable energy transaction records

- Carbon Credit Trading: Automated environmental credit management

- Decentralized Grid Management: Community-owned energy systems

Investment Landscape and Funding Trends

Funding Statistics:

- Total Funding Raised: $47.6 billion across 116 companies

- Average Funding per Company: $410.2 million

- Median Funding: $25 million

- Largest Funding Rounds: ReNew Power ($12.7B), NorthVolt ($12B), Avaada Energy ($3.7B)

Investor Categories:

1. Venture Capital (45% of funding)

- Technology-focused investors

- Clean energy specialists

- Growth stage funding

2. Strategic Corporate Investors (30% of funding)

- Utility companies

- Energy giants

- Technology corporations

3. Government and Policy Support (15% of funding)

- Green bonds

- Development banks

- Government grants and incentives

4. Private Equity (10% of funding)

- Growth and expansion capital

- Infrastructure investments

- Consolidation plays

Recent Funding Highlights (2024):

- Clean Energy VC Investment: $12.5 billion globally, up 8% from 2023[5]

- Energy Storage Focus: Record investments in battery technology and grid-scale storage[13]

- Virtual Power Plants: Emerging as major funding category with 28.4% CAGR growth[14]

Revenue Models and Market Performance

Revenue Distribution:

- Total Combined Revenue: $25.2 billion

- Average Revenue per Company: $217.1 million

- Median Revenue: $18 million

- Top Revenue Generators: ReNew Power ($5B), NorthVolt ($8B), Avaada Energy ($1.5B)

Revenue Models:

1. Subscription and SaaS (40% of companies)

- Monthly/annual software licensing

- Per-device or per-building pricing

- Tiered service offerings

2. Hardware Sales (25% of companies)

- Energy management equipment

- Smart meters and sensors

- Storage systems and inverters

3. Energy-as-a-Service (20% of companies)

- Solar-as-a-service models

- Energy efficiency guarantees

- Performance-based contracts

4. Transaction-based Revenue (15% of companies)

- Energy trading commissions

- Demand response payments

- Grid services compensation

Employment and Human Capital

Workforce Statistics:

- Total Employment: 81,829 professionals

- Average Company Size: 705 employees

- Median Company Size: 66 employees

- Largest Employers: ReNew Power (25,000), NorthVolt (15,000), Avaada Energy (15,000)

Key Skill Areas in Demand:

- Software Engineering: AI/ML, IoT, cloud platforms

- Energy Engineering: Grid systems, renewable integration

- Data Science: Analytics, predictive modeling

- Business Development: Energy markets, regulatory affairs

- Product Management: Customer experience, market strategy

Key Market Segments and Applications

1. Building Energy Management Systems (BEMS)

Market Leaders: Schneider Electric, Johnson Controls, Siemens[15]

Growth Drivers:

- Smart building adoption

- Energy efficiency regulations

- IoT device proliferation

- AI-powered optimization

Key Startups:

- BuildingIQ: Predictive HVAC optimization

- Lucid: Commercial building intelligence

- Gridium: Energy cost reduction software

2. Industrial Energy Management

Market Size: Growing at 15.6% CAGR to reach $112.32 billion by 2032[16]

Applications:

- Manufacturing process optimization

- Demand response programs

- Energy procurement management

- Carbon footprint reduction

Leading Companies:

- Metron: Industrial energy management solutions

- RightWatts: Industrial IoT platform

- Enerbrain: HVAC optimization systems

3. Virtual Power Plants (VPPs)

Market Growth: 23.4% CAGR, reaching $5.5 billion by 2029[2]

Key Functions:

- Distributed energy resource aggregation

- Grid stability services

- Energy market participation

- Renewable energy integration

Major Players:

- Voltus: Demand response aggregation

- Origami Energy: Real-time energy marketplace

- Sympower: Flexibility aggregation platform

4. Residential Energy Management

Market Drivers:

- Smart home adoption

- Solar + storage systems

- Electric vehicle integration

- Time-of-use pricing

Notable Startups:

- Sense: Home energy monitoring

- Curb: Real-time energy tracking

- Glow Energy: Rental property VPPs

Regional Market Analysis

North America

Market Characteristics:

- Leading Region: 40 companies with strong VC ecosystem

- Key Markets: United States, Canada

- Growth Drivers: IRA incentives, grid modernization, utility deregulation

- Major Hubs: San Francisco, New York, Austin, Toronto

Top Companies:

- Stem, Voltus, Arcadia Power, FreeWire Technologies

Europe

Market Characteristics:

- Regulatory Leadership: Strongest efficiency mandates and carbon pricing

- Key Markets: Germany, UK, Netherlands, France

- Growth Drivers: Green Deal, renewable energy targets, building efficiency standards

- Innovation Centers: Berlin, London, Amsterdam, Stockholm

Top Companies:

- Enpal, NorthVolt, Octopus Energy, Sympower

Asia-Pacific

Market Characteristics:

- Fastest Growing Region: 25.80% CAGR in VPP market (India)[17]

- Key Markets: India, China, Japan, Australia

- Growth Drivers: Energy access, manufacturing growth, renewable energy deployment

- Emerging Hubs: Bangalore, Mumbai, Shenzhen, Tokyo

Top Companies:

- ReNew Power, Avaada Energy, BluSmart, Exponent Energy

Technology Trends and Innovation Drivers

1. Artificial Intelligence and Machine Learning

Applications:

- Predictive Analytics: Energy demand forecasting with 95%+ accuracy

- Automated Optimization: Real-time energy dispatch and load balancing

- Anomaly Detection: Equipment failure prediction and maintenance scheduling

- Grid Stability: Frequency regulation and voltage control

Leading Innovators:

- Stem: AI-powered energy storage optimization

- AutoGrid Systems: Machine learning for grid analytics

- Innowatts: AI-driven energy insights platform

2. Internet of Things (IoT) and Edge Computing

Market Impact:

- Device Connectivity: Over 50 billion IoT devices expected by 2030

- Edge Processing: Reduced latency for real-time control

- Data Collection: Granular energy usage monitoring

- Automated Control: Demand response and load management

Key Players:

- Sense: Smart home energy monitoring

- SparkMeter: IoT-enabled smart metering

- SHYFT Power Solutions: IoT distributed energy management

3. Blockchain and Distributed Ledger Technology

Use Cases:

- Peer-to-peer Trading: Direct energy transactions between prosumers

- Grid Transparency: Immutable energy transaction records

- Carbon Credits: Automated environmental attribute trading

- Microgrid Management: Decentralized energy system control

Blockchain Pioneers:

- Power Ledger: Blockchain energy trading platform

- Flower: Distributed energy marketplace

- WePower: Renewable energy trading platform

4. Advanced Energy Storage Integration

Technology Trends:

- Battery Cost Decline: 85% reduction since 2010

- Grid-Scale Storage: Multi-gigawatt installations becoming common

- Hybrid Systems: Solar + storage + grid services

- Second-Life Applications: EV battery repurposing for stationary storage

Storage Innovators:

- Moment Energy: Second-life battery systems

- Aquion Energy: Sodium-ion battery technology

- Hydrostor: Compressed air energy storage

Challenges and Market Barriers

Technical Challenges

1. Grid Integration Complexity

- Intermittency management for renewable sources

- Bidirectional power flow coordination

- Cybersecurity for connected systems

- Interoperability between different platforms

2. Data Management and Analytics

- Massive data volumes from IoT devices

- Real-time processing requirements

- Privacy and security concerns

- Data standardization across platforms

Regulatory and Policy Barriers

1. Utility Market Structures

- Regulated monopoly resistance to change

- Rate design complexity for new technologies

- Interconnection approval delays

- Market access restrictions for aggregators

2. Evolving Standards and Codes

- Building energy codes updating slowly

- Cybersecurity requirements becoming stricter

- Grid interconnection standards varying by region

- Safety certifications for new technologies

Financial and Market Obstacles

1. High Upfront Costs

- Customer acquisition expenses

- Technology development investments

- Regulatory compliance costs

- Market education requirements

2. Long Payback Periods

- Energy efficiency savings take time to realize

- Customer financing challenges

- Uncertain regulatory environment

- Competition from low energy prices

Future Market Outlook and Opportunities

Market Growth Projections (2025-2030)

Overall Market Expansion:

- Energy Management Systems: $53.26B to $111.86B (13.0% CAGR)[1]

- Virtual Power Plants: $1.9B to $5.5B (23.4% CAGR)[2]

- Energy Storage Systems: $288.97B growing at 5.69% annually[3]

Emerging Opportunities

1. Artificial Intelligence Integration

- Market Size: AI in energy expected to reach $7.78 billion by 2030

- Applications: Predictive maintenance, automated optimization, grid stability

- Growth Areas: Edge AI, federated learning, explainable AI systems

2. Electric Vehicle Integration

- V2G Technology: Vehicle-to-grid energy storage and services

- Smart Charging: Load management and grid support

- Fleet Management: Commercial EV energy optimization

- Charging Infrastructure: Intelligent charging networks

3. Industrial Decarbonization

- Process Optimization: AI-driven manufacturing efficiency

- Electrification: Industrial heat pump and electric process heating

- Carbon Management: Real-time emissions tracking and reduction

- Green Hydrogen: Industrial hydrogen production and use

4. Residential Energy Services

- Home Energy Management: Comprehensive automation systems

- Community Energy: Neighborhood-scale microgrids

- Energy-as-a-Service: Subscription-based energy solutions

- Demand Flexibility: Advanced demand response programs

Investment Opportunities

High-Growth Segments:

- Virtual Power Plants: 23.4% CAGR opportunity[2]

- Energy Storage Integration: Multi-billion dollar market expansion[6]

- AI-Powered Optimization: Emerging technology with significant potential

- Industrial IoT Applications: Large-scale deployment opportunities

Geographic Expansion:

- Asia-Pacific: Fastest growing region with massive infrastructure needs

- Latin America: Emerging markets with renewable energy focus

- Africa: Energy access and off-grid solutions

- Eastern Europe: Grid modernization and efficiency upgrades

Strategic Recommendations

For Investors

1. Focus on Platform Companies

- Prioritize startups with scalable software platforms

- Look for companies with strong network effects

- Invest in data-driven business models

- Target companies with multiple revenue streams

2. Geographic Diversification

- Balance mature markets (North America, Europe) with growth markets (Asia)

- Consider regulatory environments and policy support

- Evaluate local partnership opportunities

- Assess market entry barriers and competitive landscapes

3. Technology Integration

- Invest in companies combining multiple technologies (AI + IoT + Storage)

- Look for interoperability and open standards adoption

- Consider cybersecurity and data privacy capabilities

- Evaluate scalability and technical differentiation

For Startups

1. Market Entry Strategy

- Start with niche markets and expand gradually

- Build strong regulatory and utility relationships

- Focus on proven ROI and customer success stories

- Develop scalable technology architectures

2. Partnership Development

- Form strategic alliances with established players

- Integrate with existing energy infrastructure

- Develop channel partnerships for market access

- Create ecosystem partnerships for complete solutions

3. Technology Development

- Invest heavily in AI and machine learning capabilities

- Ensure cybersecurity and data privacy compliance

- Build interoperable and standards-compliant systems

- Focus on user experience and customer adoption

Conclusion of the Top 100 Energy Management Startups Report

The energy management startup ecosystem represents one of the most dynamic and rapidly evolving sectors in the global clean technology landscape. With combined funding of $47.6 billion and revenue of $25.2 billion across 116 leading companies, this sector is driving fundamental transformation in how energy is generated, distributed, managed, and consumed.

The market is characterized by strong growth fundamentals, with the global energy management systems market projected to reach $111.86 billion by 2030, growing at 13.0% annually. Virtual power plants represent the fastest-growing segment at 23.4% CAGR, while energy storage systems continue to expand with massive deployment opportunities globally.

Key success factors for companies in this space include:

- Technology Integration: Combining AI, IoT, and energy storage for comprehensive solutions

- Scalable Platforms: Building software-driven business models with network effects

- Market Partnerships: Developing strong relationships with utilities, regulators, and channel partners

- Geographic Expansion: Balancing mature and emerging markets for optimal growth

- Customer Focus: Delivering proven ROI and superior user experiences

The future of energy management lies in intelligent, automated systems that can seamlessly integrate renewable energy sources, optimize consumption patterns, and provide grid stability services. Companies that can successfully navigate the complex regulatory environment while delivering compelling customer value propositions are positioned to capture significant market opportunities in this transformative sector.

As the global energy transition accelerates, driven by climate commitments and technological advancement, energy management startups will play an increasingly critical role in enabling a clean, efficient, and resilient energy future. The companies profiled in this report represent the vanguard of this transformation, with the potential to reshape how the world produces, distributes, and consumes energy for decades to come.

Appendix: Top 100 Energy Management Startups

| Startup Name | Principal Product Name | Business Model | Geography of Operation |

|---|---|---|---|

| ReNew Power | Utility-scale solar and wind farms | Renewable Energy Development | India |

| NorthVolt | Lithium-ion battery manufacturing | Hardware + Software Solutions | Sweden (Europe) |

| Avaada Energy | Solar and wind power plants | Renewable Energy Development | India |

| Redwood Materials | Battery recycling and materials recovery | Hardware + Services | United States |

| Octopus Energy | AI-powered energy retail platform | Energy-as-a-Service | United Kingdom (Global) |

| Enpal | Solar-as-a-service platform | Energy-as-a-Service | Germany |

| Huasun Energy | High-efficiency solar cells | Manufacturing | China (Asia) |

| EcoFlow | Portable power stations and home batteries | Hardware Sales | United States (Global) |

| YoCharge | AI-powered energy Management Platform | SaaS | APAC |

| Aurora Solar | Solar design and sales software | SaaS | United States |

| Stem | AI-powered energy storage management | SaaS + Hardware | United States |

| Crusoe Energy Systems | Energy infrastructure for computing | Energy-as-a-Service | United States |

| Arcadia Power | Clean energy marketplace | SaaS / Marketplace | United States |

| Carbo Culture | Carbon capture tech & biochar | Hardware + Services | Finland (Europe) |

| Voltus | Virtual power plant aggregation | Virtual Power Plant (SaaS) | United States |

| BuildingIQ | Building energy management | Software-as-a-Service | United States |

| Sense | Home energy monitoring | Hardware + SaaS | United States |

| Metron | Industrial energy management platform | Software-as-a-Service | France (Global) |

| Sympower | Flexibility aggregation platform | Virtual Power Plant (SaaS) | Netherlands (Europe) |

| Power Ledger | Blockchain energy trading | Energy Trading Platform | Australia (Asia-Pacific) |

| AutoGrid Systems | AI-powered grid optimization | Software-as-a-Service | United States (Global) |

| FreeWire Technologies | Mobile battery and EV charging | Hardware Sales | United States |

| Origami Energy | Real-time energy marketplace | SaaS/Marketplace | United Kingdom (Europe) |

| Flower | Distributed energy trading | Energy Trading Platform | Sweden |

| WePower | Renewable energy trading | Energy Trading Platform | Australia (Europe |

| Moixa | Smart battery systems | Hardware + SaaS | United Kingdom |

| Curb | Real-time home energy monitor | Hardware + SaaS | United States |

| Glow Energy | Smart rental VPP platform | Virtual Power Plant (SaaS) | United States |

| Enerbrain | HVAC optimization system | Software-as-a-Service | Italy |

| Gridium | Energy cost reduction analytics | SaaS | United States |

| SHYFT Power Solutions | IoT distributed energy management | Hardware + SaaS | Nigeria (Africa) |

| SparkMeter | Smart metering hardware | Hardware Sales | United States (Global) |

| Moment Energy | Second-life battery systems | Hardware Sales | Canada |

| Aquion Energy | Sodium-ion battery units | Hardware Sales | United States |

| Hydrostor | Compressed air energy storage | Hardware & Project Development | Canada (Global) |

| Dexter Energy | Energy market optimization | Software-as-a-Service | Netherlands |

| Glow | IoT-enabled home energy | Hardware + SaaS | Thailand |

| Enbala Power Networks | Fleet VPP control platform | Virtual Power Plant (SaaS) | Canada (Global) |

| Control4 | Smart building automation | Hardware + SaaS | United States |

| Smartwatt | Building energy optimization platform | SaaS | Portugal |

| BeeBryte | AI-driven HVAC automation | Software-as-a-Service | France |

| JouleSmart | Small business energy management | Software-as-a-Service | United States |

| FlexiDAO | Energy traceability blockchain | SaaS/Blockchain | Spain |

| Encycle | Smart commercial load control | Hardware + SaaS | United States |

| RightWatts | Industrial IoT for energy | Hardware + SaaS | United States |

| Sunverge | Distributed energy resource software | Software-as-a-Service | United States (Australia) |

| Blue Pillar | Microgrid and DER control | Software-as-a-Service | United States |

| Empower | Community solar platform | SaaS | United States |

| GridBeyond | Industrial VPP aggregation | Virtual Power Plant (SaaS) | Ireland |

| EnPowered | Energy market payments platform | SaaS | Canada |

| Tibber | AI-powered energy retailer | Energy-as-a-Service | Norway (Europe) |

| SenseHawk | Solar asset management software | SaaS | United States (India) |

| Enervee | Digital marketplace for efficient products | SaaS/Marketplace | United States |

| Enertiv | Building operations analytics | SaaS | United States |

| WattTime | Automated emissions reduction | Software-as-a-Service | United States |

| OhmConnect | Residential demand response | SaaS/Platform | United States |

| Uplight | Customer energy engagement | SaaS/Marketplace | United States |

| Opus One Solutions | DER network optimization | Software-as-a-Service | Canada |

| GoWithFlow | Fleet EV energy management | Software-as-a-Service | Portugal (Europe) |

| Dexma | Commercial energy analytics | Software-as-a-Service | Spain |

| Joule Assets | Energy financing solutions | Financing Platform | United States |

| EnergyHub | Grid-connected device management | Software-as-a-Service | United States |

| ENGIE Impact | Sustainability consulting & tools | Advisory + SaaS | France (Global) |

| Axiom Energy | Refrigeration load shifting | Hardware + SaaS | United States |

| Budderfly | Small business energy efficiency | Energy-as-a-Service | United States |

| Wattsense | Building device connectivity hardware | Hardware | France |

| Leap | Grid market DER aggregation | Virtual Power Plant (SaaS) | United States |

| ZOLA Electric | Off-grid solar home systems | Hardware + Service | Netherlands (Africa) |

| Carbon Clean | CO2 capture hardware | Hardware + Services | United Kingdom (Global) |

| Envelio | Grid digital twin platform | Software-as-a-Service | Germany |

| Solar Analytics | Residential solar monitoring | Software-as-a-Service | Australia |

| d.light | Off-grid solar lighting | Hardware + Service | United States (Africa |

| EVBox | EV charging infrastructure | Hardware + SaaS | Netherlands (Europe) |

| Bidgely | AI-powered utility analytics | SaaS | United States |

| MeterGenius | Customer energy engagement | SaaS | United States |

| HomeBiogas | Biogas home digesters | Hardware Sales | Israel (Global) |

| Piclo | Flexibility marketplace platform | SaaS | United Kingdom |

| Agilitas Energy | Energy storage systems | Project Development | United States |

| Phood | Food waste energy reduction | SaaS | United States |

| Grid Singularity | Blockchain grid management | Energy Trading Platform | Austria |

| EnergyWeb Foundation | Blockchain-based grid apps | Open Source Platform | Switzerland (Global) |

| Greenlots | EV smart charging platform | Software-as-a-Service | United States |

| Centrica Digital | Energy optimization SaaS | SaaS | United Kingdom |

| Virtual Peaker | DERMS (distributed energy resource management) | Software-as-a-Service | United States |

| Faraday Grid | Grid hardware innovation | Hardware | United Kingdom |

| Solshare | P2P solar energy trading | Platform | Bangladesh |

| Enercoop | Renewable electricity cooperative | Co-op | France |

| Sonnen | Residential batteries + VPP | Hardware + SaaS | Germany |

| MPrest | Advanced utility control platform | Software-as-a-Service | Israel |

| KWI | Energy trading and risk | Software-as-a-Service | United States |

| GridX | EV and smart home metering | Software-as-a-Service | Germany |

| Loowatt | Energy-from-waste solutions | Hardware + Service | United Kingdom |

| Smappee | Smart energy monitoring sensors | Hardware Sales | Belgium |

| RedT Energy | Flow battery systems | Hardware Sales | United Kingdom |

| SunCulture | Solar irrigation solutions | Hardware + Service | Kenya |

| Enershare | Community solar platform | SaaS | United States |

| SolarNow | Pay-as-you-go solar | Hardware + Service | Netherlands (Africa) |

| Azuri Technologies | Off-grid solar paygo tech | Hardware + Service | United Kingdom (Africa) |

| Ecoisme | Home energy monitor | Hardware Sales | Ukraine (Europe) |

| VCharge | Smart grid load control | SaaS/Platform | United States |

| GreenCom Networks | IoT smart energy platform | Software-as-a-Service | Germany |